Automated Software for Close Company Rules

A company is ‘close’ under the UK’s Corporation Tax Acts if the group of people controlling it is too small. If a company is, or is not, close, there are significant tax consequences. The rules determining whether a company is close or not are easy to apply in simple cases, but the analysis quickly spirals to become tortuously complex.

AORA’s close company tool makes those complex cases straightforward. It precisely identifies the crucial pieces of information that need to be sought from a client. It then performs the analysis and calculations required by the rules in seconds, testing every possible situation and available exception to identify whether and exactly why a company is close.

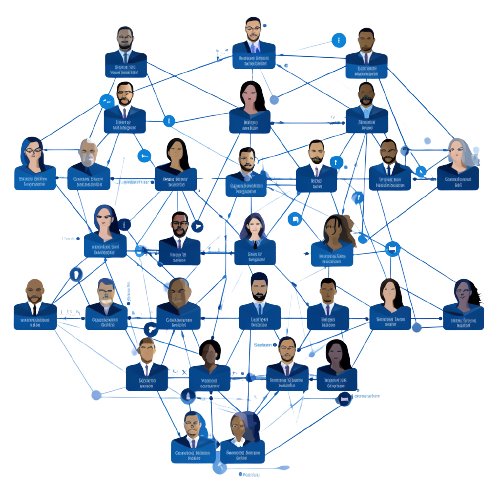

AORA's close company tool simplifies and speeds up the determination of complex cases in close company regulation. It generates a comprehensive and attractive explanation of the analysis it has run and the outcome it has reached using high-quality prose, easily legible tables and attractive automatically-generated diagrams.

Our reports are ready for review and strategic input by senior practitioners. Their comprehensive footnoting makes them an ideal learning tool for junior team members finding their way around this complex area of law for the first time.

Contact us today to learn how our technology can transform YOUR practice.