Software for Automated Assessment of UK REITs

UK Real Estate Investment Trusts (REITs) are tax-efficient property investment vehicles. No corporation tax is paid on the profits of a REIT’s UK property rental business. Instead, the tax charge is pushed back to the investors as though they had invested directly in the property. UK REITs, therefore, combine the tax benefits of a direct property investment with the economies of scale that come with investing through a fund.

To qualify, a company must meet several strict technical conditions. AORA’s REIT tool covers all the criteria a company needs to satisfy to enter this desirable regime.

For advisory practices such as accountants or tax advisors, AORA increases capacity and revenue for servicing REIT business and reduces cost and dependence on specialist staff normally needed to do this work. Bids for new REIT projects can be offered with competitive pricing and faster delivery times. The speed and efficiency of AORA's REIT tool allow practitioners to easily design REITs.

Our Professional Services Package allows data inputs to be quickly and conveniently changed to produce alternative scenarios for comparison. Potential grey areas and speculative positions are eliminated from the analysis, making exploring options and optimising a client’s tax position significantly easier. The resultant effect on the quality of service offered is profound.

AORA’s reports are ready for immediate review and strategic input by users. Their comprehensive footnoting makes them an ideal learning tool for junior staff finding their way around this complex area of law for the first time. The discipline and diligence inherent to these results, alongside the suitability and usability of the documentation generated, mean radical improvements to the entire process of evaluating REIT eligibility.

Institutional investors and fund administrators please visit our REIT feasibility service package.

For more information, please phone +44 203 3899422 or email reit@aoralaw.com

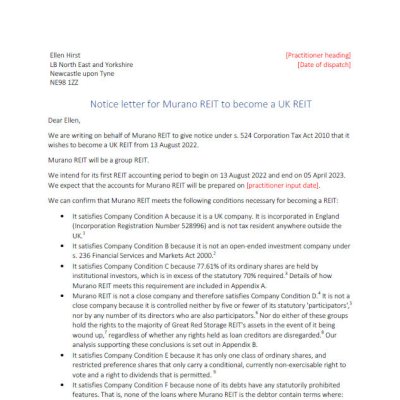

Complex Case Success Letter HMRC

Example output of a letter to HMRC confirming eligibility for a client to become a UK REIT.

View

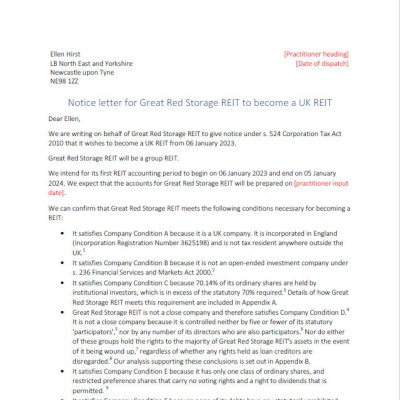

Simple Case Success Letter HMRC

Example of ouput letter for simple case which meets the criteria for becoming a UK REIT.

View

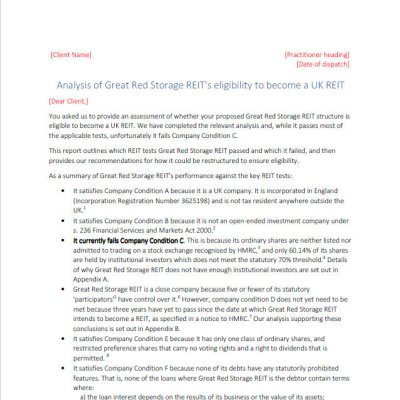

Simple Case Fail Letter to a Client

Example of letter output for a case which fails to meet the requirements to become a UK REIT.

View